Image Credits: Shutterstock, Pixabay, Wiki Commons

Via this site.

4 min read

Fraud continues to be on the rise where cryptocurrency is concerned. It seems to be the latest trend where scammers are concerned.

Since the start of 2021, more than 46,000 people have reported losing over $1 billion in crypto to scams[1] – that’s about one out of every four dollars reported lost,[2] more than any other payment method. The median individual reported loss? A whopping $2,600. The top cryptocurrencies people said they used to pay scammers were Bitcoin (70%), Tether (10%), and Ether (9%).[3]

Crypto has several features that are attractive to scammers, which may help to explain why the reported losses in 2021 were nearly sixty times what they were in 2018. There’s no bank or other centralized authority to flag suspicious transactions and attempt to stop fraud before it happens. Crypto transfers can’t be reversed – once the money’s gone, there’s no getting it back. And most people are still unfamiliar with how crypto works. These considerations are not unique to crypto transactions, but they all play into the hands of scammers.

Reports point to social media and crypto as a combustible combination for fraud. Nearly half the people who reported losing crypto to a scam since 2021 said it started with an ad, post, or message on a social media platform.[4]

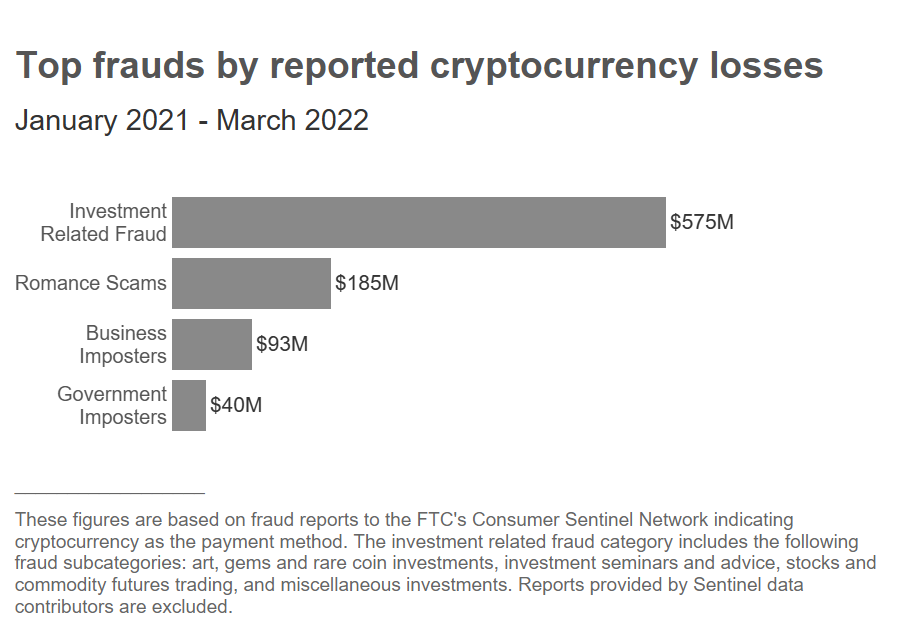

Of the reported crypto fraud losses that began on social media, most are investment scams.[7] Indeed, since 2021, $575 million of all crypto fraud losses reported to the FTC were about bogus investment opportunities, far more than any other fraud type. The stories people share about these scams describe a perfect storm: false promises of easy money paired with people’s limited crypto understanding and experience. Investment scammers claim they can quickly and easily get huge returns for investors. But those crypto “investments” go straight to a scammer’s wallet. People report that investment websites and apps let them track the growth of their crypto, but it’s all fake. Some people report making a small “test” withdrawal – just enough to convince them it’s safe to go all in. When they really try to cash out, they’re told to send more crypto for (fake) fees, and they don’t get any of their money back.

Romance scams are a distant second to investment scams, with $185 million in reported cryptocurrency losses since 2021 – that’s nearly one in every three dollars reported lost to a romance scam during this period.[8] And many have an investment twist too. These keyboard Casanovas reportedly dazzle people with their supposed wealth and sophistication. Before long, they casually offer tips on getting started with crypto investing and help with making investments. People who take them up on the offer report that what they really got was a tutorial on sending crypto to a scammer. The median individual reported crypto loss to romance scammers is an astounding $10,000.

Business and government impersonation scams are next with $133 million in reported crypto losses since 2021. These scams can start with a text about a supposedly unauthorized Amazon purchase, or an alarming online pop-up made to look like a security alert from Microsoft. From there, people are reportedly told the fraud is extensive and their money is at risk. The scammers may even get the “bank” on the line to back up the story. (Pro tip: it’s not the bank.) In another twist, scammers impersonating border patrol agents have reportedly told people their accounts will be frozen as part of a drug trafficking investigation. These scammers tell people the only way to protect their money is to put it in crypto: people report that these “agents” direct them to take out cash and feed it into a crypto ATM. The “agent” then sends a QR code and says to hold it up to the ATM camera. But that QR code is embedded with the scammer’s wallet address. Once the machine scans it, their cash is gone.

People ages 20 to 49 were more than three times as likely as older age groups to have reported losing cryptocurrency to a scammer.[9] Reports point to people in their 30s as the hardest hit – 35% of their reported fraud losses since 2021 were in cryptocurrency.[10] But median individual reported losses have tended to increase with age, topping out at $11,708 for people in their 70s.[11]

Here are some things to know to steer clear of a crypto con:

To learn more about cryptocurrency scams – and how to spot and avoid scams generally – visit ftc.gov/cryptocurrency and ftc.gov/scams. Report scams to the FTC at ReportFraud.ftc.gov.

Via this site.

A cryptocurrency trader has been convicted in the U.S. for operating an unlicensed money-transmitting business using Localbitcoins and Paxful. He faces up to five years in federal prison and a possible $250,000 maximum fine.

The U.S. Department of Justice (DOJ) continues to take action against crypto traders using services such as Localbitcoins and Paxful to buy and sell cryptocurrencies as a business without a license. The latest such case involved Hien Ngoc Vo, a 49-year-old man from Seattle, Washington, who operated an unlicensed crypto business in Houston, Texas.

The DOJ announced Wednesday that Vo has pleaded guilty to running an unlicensed money transmitting business in the Houston area between March 16 and June 8, 2016. The Department of Justice detailed:

Vo used Paxful and Localbitcoins to buy and sell bitcoin … He profited from sales by collecting a percentage of the transactions which ranged from 5-30%.

Within the three months specified, Vo’s unlicensed business received and transmitted approximately $515,147.19 in BTC, the DOJ described, adding that customers paid him in cash, direct bank deposits, American Express credit cards as well as Amazon and generic gift cards.

However, “During the transactions, Vo did not ask clients for any form of identification nor the purpose for which they were purchasing the cryptocurrency,” the Justice Department noted.

Noting that Vo is permitted to remain on bond pending sentencing on Sept. 5, the DOJ concluded:

Vo faces up to five years in federal prison and a possible $250,000 maximum fine.

Disclaimer: Although the material contained in this website was prepared based on information from public and private sources that TELcrush.com believes to be reliable, no representation, warranty or undertaking, stated or implied, is given as to the accuracy of the information contained herein, and TELcrush.com expressly disclaims any liability for the accuracy and completeness of the information contained in this website.