Image Credits: Shutterstock, Pixabay, Wiki Commons

While most agree the cryptocurrency market is going through a tough bear market, there are those coins that are managing to hold their own. As Bitcoin and Ethereum continue a downward trend over the last month, USDT is showing 30 day stability.

BTC vs ETH vs USDT 30 Day Charts

These charts from CoinMarketCap.com all taken at 1:55pm EST, June 28, 2022, tell the story:

USDT Chart

BTC Chart

ETH Chart

But USDT is not the only stablecoin experts are looking at right now.

Bitcoin and Ethereum Dominance Has Dropped Over the Last Month

The crypto bear market has done some damage to the digital currency economy and many continue to wonder if the market carnage will continue. The market has seen a brief consolidation period after the most recent sell-off, which took BTC down to $17,593 per unit and ETH dipped to $877 per coin.

Both coins have seen a significant amount of fiat value removed since last month and BTC’s and ETH’s market dominance has decreased since then as well. At the time, BTC was trading for $28,946 per unit on May 27, 2022, and ETH was exchanging hands for $1,745 per unit.

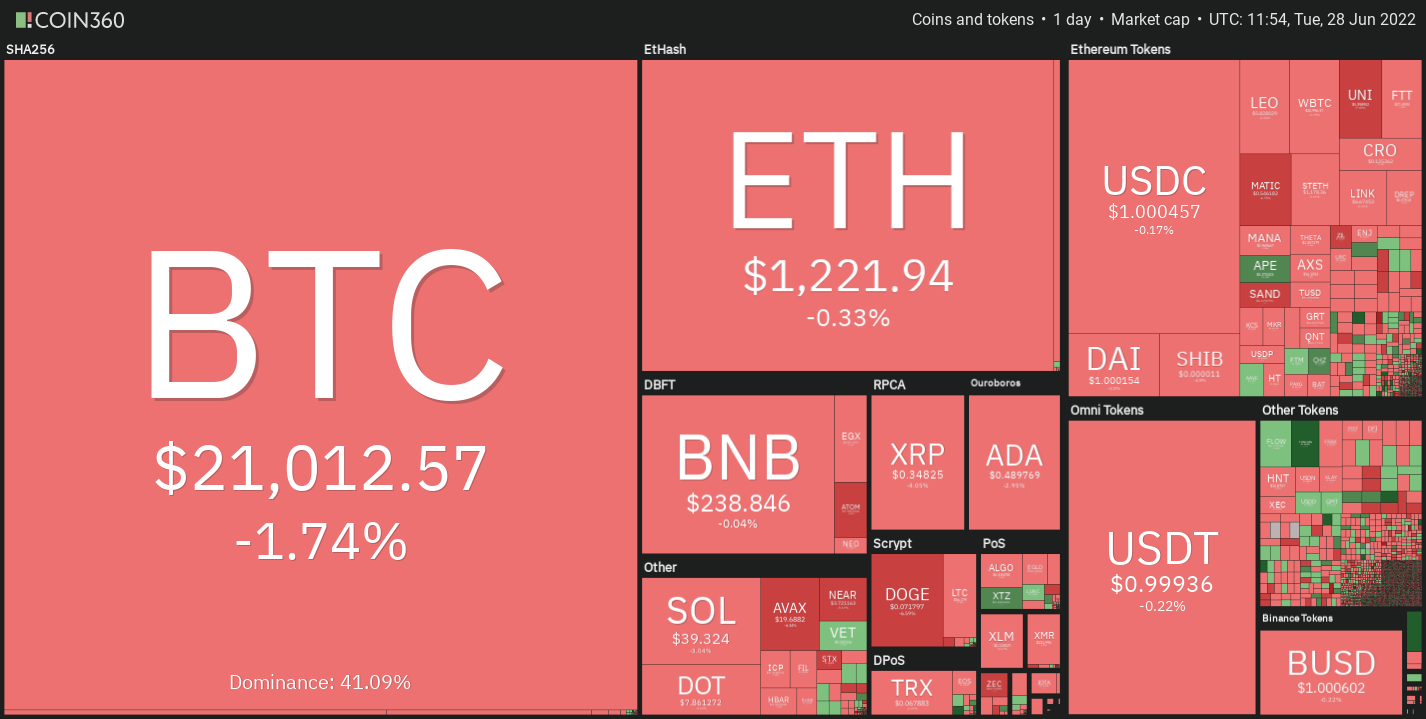

At the time of writing, BTC is exchanging hands for just above $21K per unit, while ETH is swapping for $1,221 per unit. BTC dominated the $1.25 trillion crypto economy by 43.9% on that day and ETH had a dominance rating of 17.1%. 30 days later, data shows that BTC’s current dominance is 41%, while ETH commands 15% of the entire crypto economy.

Tether, USD Coin, and BUSD Dominance Swells

The stablecoin tether (USDT) captures 6.94% of the digital currency economy’s net value and usd coin (USDC) commands 5.77%. Tether’s market cap has grown since last month as it was hovering around 5.72% at that time.

In mid-May, USDC’s market capitalization represented 3.77% of the crypto economy. The Binance-issued stablecoin BUSD equated to 1.43% of the crypto economy in terms of dominance, and today it’s 1.8%. In fact, between USDT, USDC, and BUSD, the combined market capitalizations equate to 14.51%, which is just shy of ETH’s 14.7% dominance rating.

While BTC saw $18.7 billion in global trade volume during the past 24 hours and ETH saw $13.5 billion, the combined $32.2 billion in trade volume is still eclipsed by USDT’s $48.58 billion during the last day. Out of all the 24-hour BTC trades, 60.62% of those bitcoin trades are paired with tether (USDT).

With lower dominance ratings for both BTC and ETH, it seems sellers gravitated towards stablecoins. This trend suggests that it is possible but not guaranteed that much of the stablecoin funds are people waiting on the sideline for ETH’s and BTC’s official bottoms.

Via this site.

Disclaimer: Although the material contained in this website was prepared based on information from public and private sources that TELcrush.com believes to be reliable, no representation, warranty or undertaking, stated or implied, is given as to the accuracy of the information contained herein, and TELcrush.com expressly disclaims any liability for the accuracy and completeness of the information contained in this website.