One question that often comes to mind when first learning about the cryptocurrency market is, what is a stablecoin and why even use it?

According to Flexiple.com, “Stablecoins are cryptocurrencies that are often expressed in dollars. Thanks to these dollar-indexed coins, you have the opportunity to maximize your chances of protection from market fluctuations or risks.”

Since the Terra crash, the reliance on stablecoins staying stable has come under close scrutiny. Are they still being heavily utilized in cryptocurrency trading?

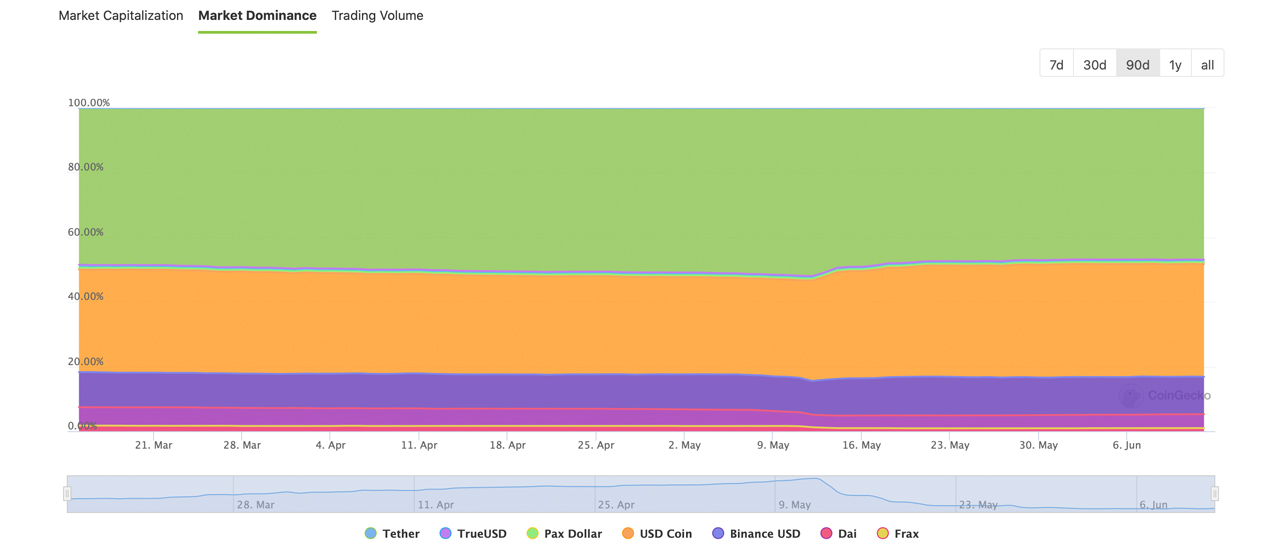

In 61 Days, Stablecoin Dominance Swelled From 9% to 13.8%

For the first time in history, three stablecoins were top ten digital currencies in terms of market valuation 36 days ago on May 6, 2022. At the time, it was tether (USDT), usd coin (USDC) and terrausd (UST), but that was before the UST implosion.

While terrausd is gone, there’s still three stablecoins in the top ten today, as binance usd (BUSD) is the seventh-largest crypto asset as far as market cap is concerned. Two months ago on April 11, the stablecoin economy was valued at $190 billion but today, the valuation of the stablecoin market is now $159 billion.

On that day in April, the entire crypto economy was valued at $2.03 trillion and today it’s worth roughly $1.15 trillion. Even though Terra’s UST fallout saw billions leave the stablecoin economy, it dominates by a lot more than it did when it was nearing $200 billion.

Stablecoins account for whole lot of trade volume as well, and at the time of writing, fiat-pegged tokens have seen $46.1 billion in trade volume, while all the crypto assets combined saw $71.6 billion. The data shows that 64.38% of all the digital currency trades today are swapped against stablecoin pairs.

For instance, tether (USDT) trades account for 60.26% of bitcoin’s (BTC) global trade volume while BUSD commands 10.05%. USDT and BUSD are BTC’s top two trading pairs at the time of writing, according to cryptocompare.com metrics.

Tether (USDT) is still the king of stablecoins with an $72 billion market valuation that represents more than 6% of the entire crypto economy. Usd coin (USDC) is the second-largest stablecoin by market cap with $53.7 billion in value.

USDC dominates today by more than 4% of the crypto economy and combined both USDC and USDT make up 76.92% of the entire stablecoin dominance of 13.40%. BUSD meanwhile, represents 1.58% of the entire crypto economy. That leaves a little more than 1% of the crypto economy that stem from stablecoins like DAI, FRAX, TUSD, and USDP.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Via this site.

Disclaimer: Although the material contained in this website was prepared based on information from public and private sources that TELcrush.com believes to be reliable, no representation, warranty or undertaking, stated or implied, is given as to the accuracy of the information contained herein, and TELcrush.com expressly disclaims any liability for the accuracy and completeness of the information contained in this website.