The LUNA crash has claimed another victim. Prominent crypto hedge fund 3AC is now facing possible insolvency after Bitmix and Derebit pull out.

Looking for Options

Per Coindesk: Beleaguered cryptocurrency fund Three Arrows Capital (3AC) confirmed Friday it had suffered heavy losses in the recent market downturn and said it had hired legal and financial advisors to figure a way out, according to a WSJ report.

-

“We are committed to working things out and finding an equitable solution for all our constituents,” 3AC co-founder Kyle Davies told the WSJ. The fund had over $3 billion worth of cryptocurrencies under management as of April.

-

3AC is exploring options including asset sales and a rescue by another firm and hopes to reach a settlement with creditors, Davies said. 3AC owes at least $6 million to crypto exchange BitMEX, as per a separate report by The Block today.

-

Davies said 3AC invested over $200 million in LUNA tokens as part of a $1 billion raise by the Luna Foundation Guard in February, an amount that is now essentially worthless since the Terra ecosystem imploded in mid-May. “The Terra-Luna situation caught us very much off guard,” Davies told the WSJ.

-

LUNA lost nearly all of its value over the course of a week, while ecosystem algorithmic stablecoin terraUSD (UST) fell to a few pennies after losing its intended peg with the U.S. dollar.

-

3AC was additionally known as one of the largest holders of Grayscale Bitcoin Trust (GBTC), an institutional bitcoin product, as well as staked ether (stETH) tokens, both of which have seen steep declines recently (Grayscale and CoinDesk are independent subsidiaries of the Digital Currency Group).

-

Davies added that 3AC was working on quantifying its losses and valuing its illiquid assets, which include many venture-capital investments in crypto startups.

-

Meanwhile, Nichol Yeo, a partner of law firm Solitaire LLP, which is advising 3AC, told the WSJ that it was keeping Singapore’s financial regulator, the Monetary Authority of Singapore, apprised of 3AC’s recent developments.

Crypto Platforms Liquidate

There’s a lot of rumors and speculation surrounding the crypto hedge fund Three Arrows Capital (3AC), and it seems to be affecting other crypto companies as well. Arguably, 3AC’s problems started with its investment into the Terra blockchain, as it purchased $559 million worth of locked LUNA (now luna classic), which is now worth just under $700. The Twitter account called The Defi Edge (@thedefiedge) explained in a Twitter thread that after the Terra fallout, 3AC allegedly tried to get funds back by using more leverage to earn back its Terra investment losses.

Although, markets shuddered even more after the Terra LUNA and UST implosion, causing a significant amount of liquidations across the entire crypto industry. Another account called Degentrading (@hodlkryptonite) said 3AC borrowed from every major lender and the firm faced significant liquidations this week. Furthermore, there’s been speculation that 3AC was dumping a great deal of Lido’s wrapped ether product called stETH, which was putting a burden on the stETH peg. Then a company backed by 3AC called Finblox detailed that it had to pause rewards (up to 90% APY) for all of its users, and the platform upped withdrawal limits as well.

Furthermore, after The Defi Edge finished his Twitter thread, a company (Protocol X) that 3AC invested in and wished to remain anonymous, told The Defi Edge that 3AC was holding the project’s treasury. “3AC invests in different seed rounds of companies. The protocol raises money usually in USDC / USDT. Well, the treasury is usually sitting around doing nothing. So a common deal 3AC did with their protocols is ‘manage’ their treasury,” The Defi Edge wrote. The Twitter account added:

3AC’s Treasury Management. 3AC gave an 8% APR guarantee on the treasury. So protocols would park the funds raised by 3AC + additional parts of their treasury. The protocols felt safe because well…it’s 3AC. Protocol X has mentioned that the ghosting is real. They’ve talked to two other protocols who also mentioned that they’re being ghosted too by them. 3AC now holds part of their treasury, and they have no idea what’s the state of their cash.

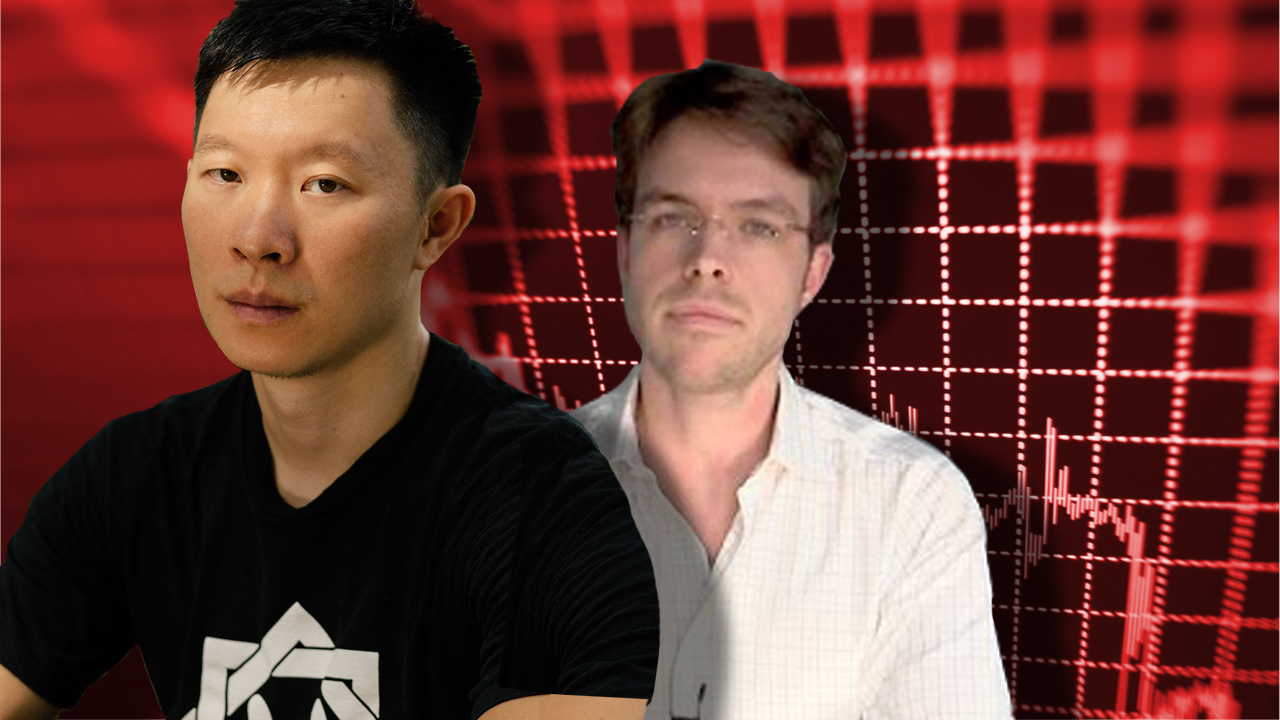

Bitmex and Deribit Liquidate 3AC Positions, Co-Founder Kyle Davies Says the Hedge Fund Is ‘Finding an Equitable Solution for All Constituents’

Additionally, a report published by The Block notes that Bitmex liquidated 3AC’s positions but did not disclose how much was liquidated. “This was collateralised debt and did not involve any client funds,” a Bitmex spokesperson told The Block. “We are not going to be like other brands and wax poetic about our limited exposure and strong capital position — instead, we will demonstrate it by providing our users a reliable and liquid trading venue every day, no matter the situation.” On Twitter, the crypto derivatives exchange Deribit also disclosed information about 3AC’s business dealings.

“We can confirm that Three Arrows Capital is a shareholder of our parent company since February 2020,” Deribit said on Thursday. “Due to market developments, Deribit has a small number of accounts that have a net debt to us that we consider as potentially distressed. Even in the event that none of this debt is repaid to us, we will remain financially healthy and operations will not be impacted. We can confirm all customer funds are safe and the full insurance fund will remain intact as is. Any potential losses will be covered by Deribit,” the exchange added.

The same report published by The Block notes that the editorial’s author contacted both FTX and Bitfinex about 3AC dealings as well. FTX told The Block author Yogita Khatri that they do not comment on their customers, and Bitfinex explained that it “had closed its positions at a loss without having to be liquidated,” Khatri’s report details. According to the Bitfinex statement, 3AC has removed all of its funds from the company’s exchange. Since the rumors and speculation started to swirl around 3AC’s business dealings, so far, the public has only heard from the company’s co-founder Su Zhu once on Twitter.

The cryptic tweet doesn’t really get into any specifics, but says: “We are in the process of communicating with relevant parties and fully committed to working this out.” 3AC’s co-founder Kyle Davies has not tweeted since June 9. Davies, however, did speak with the Wall Street Journal (WSJ) and said: “We have always been believers in crypto and we still are. We are committed to working things out and finding an equitable solution for all our constituents.” The WSJ report noted that 3AC was looking for help from “legal and financial advisers” in order to quell the company’s financial burdens.

Image Credits: Shutterstock, Pixabay, Wiki Commons